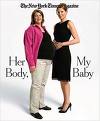

Maybe you can carry a rich lady's baby for money?

“Goldman posted the richest quarterly profit in its 140-year history and, to the envy of its rivals, announced it had earmarked $11.4 billion so far this year to compensate its workers.

At that rate, Goldman workers could, on average, earn roughly $770,000 each this year — or nearly what they did at the height of the boom.

Only three years ago, Goldman paid more than 50 employees above $20 million each. In 2007, CEO Lloyd Blankfein collected one of the biggest bonuses in corporate history.

The latest headline results — $3.44 billion in profit during its second quarter ”

Seattle Times.

Yes you just read that Goldman Sachs had a record earning quarter. What about you? How have you done this quarter? How have your friends done this quarter? How has your family done this quarter? In the past two weeks I have known FIVE people who have been laid off from their jobs. This does not include people that I know who have been out of work for months.

According to some facts from the Fight Back Article, US in Longest Recessions Since the 1930s by Adam Price this is what it looks like out there for rest of  the quarter that Goldman Sachs had record earnings.

The economy has lost almost 6 million jobs (4.1% of total jobs) since 12/07, the worst downturn since the recession of 1948. Unemployment among African Americans hit a depression-level 15% in April, unemployment for Asian Americans has risen the fastest. 8.5 million people are on unemployment. 10.6% of the US is on food stamps. People on average are out of work five months. More than one-quarter of homeowners are ‘underwater’ with mortgages greater than the value of their home during the first three months of 2009. Apartment renters are being hit as former homeowners are competing for a place to live, keeping rents up (I know of three people who have had rent increases in the last few months, I probably know of more, but haven’t asked) even with the rising unemployment. During the first three months of 2009, 15% of houses were vacant, or more than 19 million homes.

I understand the economy turning around takes time, but you know it didn’t seem to take much time for Goldman Sachs. Goldman Sachs who just in October (of 2008) had lost 50% of its value and then got 12.9 billion dollars of OUR MONEY seemed to have made quite a quick turn around. (For reference the entire state of California is in the hole 16 billion dollars, so the gov’t spent 12.9 billion of our tax dollars for this one company, what’s worse is Sachs only got a portion of the AIG bailout the total was 101 billion and more than half of that went to financial institutions in Europe.)

Why do we have to always wait while rich people get life jackets attached to yachts? I thought we were all supposed to be buckling down and saving and being responsible. I thought we were all in this together. Apparently the same rules don’t apply to rich people.

So the average worker at Goldman Sachs has the potential of earning 770,000 dollars this year, while the rest of the country is practically in a depression.

Some more fun facts:

In June retail lost 21,000 jobs.

In June temporary work lost 38,000 jobs.

In June the federal gov’t lost 49,000 jobs.

These are the fields people tell you to go into when you lose your job, but unfortunately there are no jobs in these fields. There is nothing out there. Nothing at all, look on craigslist, there are no jobs. When is the gov’t going to create jobs that you don’t have to know someone to get?

More facts:

In June information lost 21,000 jobs

Long-term (27 weeks are more) unemployment has jumped to 4.4 million.

The number of persons working part time for economic reasons

(sometimes referred to as involuntary part-time workers) was little

changed in June at 9.0 million. Since the start of the recession, the

number of such workers has increased by 4.4 million.

Facts gotten from the BLS

To end on a positive note, healthcare added 21,000 jobs, but that’s not exactly a field you can go to without going to school. On the school front Los Angeles City College and Los Angeles Trade Tech College are in danger of losing their accreditations (if your school loses its accreditation the units are not transferable to a four year institution.) East LA College and Pasadena City College were given warnings. Oh well I tried to be positive.

Browne Molyneux

Don’t forget that folks looking to go to local colleges to get into the healthcare field face years long waiting lists to even start training for those jobs.

Great post Browne, things are tough out here, money’s too tight to mention, and even the people who have a little coin are hanging on to it like it’s gonna be their last dime. That’s not good for the economy!

And after all the bail outs of the probably doomed laissez faire Capitalist financial system including Wall St first and foremost, here “we” sit, shitting in our pants and waiting for the axe to fall at the plantation cotton fields.

The only way out of the situation in my opinion, and according to many other’s I respect, is jobs, jobs, jobs, and I don’t mean flipping burgers down at McDonald’s but good paying jobs.

Enough of the failed right wing trickle down theory of economics, aka dog eat dog until Masta drops the bone,

If Obama continues to listen to Wall St lackeys like Geithner to the detriment of the people who need jobs, medical care, debt relief, and a say so in how our country is managed then he may find himself out of a job and kicking empty beer cans down the road.

Thanks for breaking it down, you can’t deny the reality when all those numbers are staring you in the face.

It seems like folks are hanging on to illusions, they want things to go back to “normal.” But things have been pretty shitty for a long time. When the economy was doing well, it was only because everyone was living on credit and spending money they didn’t have. Is that what people want again?

I’ve heard some of the more practical economists say the next direction we’re headed in is currency devaluation a la Argentina. I don’t see why this won’t happen. It’s all a house of cards and it’s only faith propping it up. One little breeze and it all falls down…

Thanks for the post, Browne.

There were more jobs in the ’90s, and there was a lot more regulation in lending. I would take that economy back, actually. What we saw under Bush was both jobs and regulation disappearing. I had bad credit in the ’90s, and I couldn’t get a credit card anywhere. Wells Fargo laughed when I asked them for one. Then suddenly by about ’01 or ’02, even with my shit credit, I started getting a boat load of credit card offers. I never bit, because I was just smart enough to read the interest rates (20%, all of them!). That credit was not available in the ’90s, at least not to me. But suddenly Capitol One and Citibank saw me as a fit borrower! Sumthin wuz up.

What I’m surprised about is how no one seems to think this is a big deal. I’m getting emails on an almost daily basis on friends who have lost their jobs or have been unemployed for awhile and have run out of saving and now need to know how to get food stamps.

And many of these people are college graduates who had good jobs. I have associates who have lost their homes or owe more on their house than what the house is worth. This is going on everywhere in America and around the world.

I was reading an article by Barbara Ehrenreich in the NY Times and in it they said the true unemployment rate in Los Angeles is around 20%.

http://www.nytimes.com/2009/06/14/opinion/14ehrenreich.html?_r=1&pagewanted=all

“the real unemployment rate, including underemployed people and those who have given up on looking for a job, is estimated at 20 percent ”

On the busses and trains I see everyone looking in the classifieds and who does that anymore, but these are people who don’t have access to a computer, but not like it would matter. I haven’t seen any jobs online anyway.

Browne

my anti-spam word is NO GOD…

sounds pretty fitting to this story.

I think if Goldman Sachs is doing so well..they should be repaying every single penny the government gave them….

I personally have been having a good July- work and money wise. I am at my January 2009 level but overall i am still down about 20% compared to 2008.

But im not bitter or angry or mad..I say..” at least im not married, so i dont have to support a wife…because im gay and i cant get married, and also i dont have any children.”

Ive cut back by spending less- I dont go out to eat as often as before and i have no cable and i got a prepaid cell phone.

Plus i have a career/job that i really enjoy and it allows me to use my imagination and creativity.

I even blew/lost/donated $25 bucks to the CAlifornia Lottery via my purchase of 25 scratchers- and i didnt win jack!

I am grateful for the little things…..while my gay friends are going on vacations to Costa Rica and Spain….I will have a staycation and hit San Diego or Santa Cruz and maybe hit one of the indian casinos!-two guys can get drunk and have sex in CA you dont have to leave the country! 🙂